Navigating the Import Process: A Comprehensive Guide for Kenyan Entrepreneurs

Importing goods from other countries can be a lucrative venture for Kenyan entrepreneurs. Whether you’re sourcing products from China, Turkey, India, or Dubai, understanding the import process is crucial. In this comprehensive guide, we’ll walk you through the essential steps and documentation required to successfully navigate the import journey.

1. Understanding the Basics

Before diving into the specifics, let’s cover the fundamental aspects of importing:

- Customs Clearing Agent: To clear any imported goods, such as cars, machinery, or general merchandise, you’ll need to engage a licensed customs clearing agent. They play a vital role in facilitating the import process.

2. Required Documents

When working with your preferred clearing agent, ensure you have the following documents:

- Import Declaration Forms (IDF): These forms provide essential information about the goods you’re importing.

- Customs Declaration (Entry): Declare the goods on the customs portal (e.g., SIMBA).

- Certificate of Conformity (CoC): For regulated products, obtain a CoC from the Pre-Export Verification of Conformity (PVoC) agent.

- Import Standards Mark (ISM): If applicable, ensure compliance with local standards.

- Valid Commercial Invoices: Obtain these from the exporting firm.

- Valid Pro Forma Invoices: Also from the exporting firm.

3. Additional Required Documents

Beyond the basics, consider these additional documents:

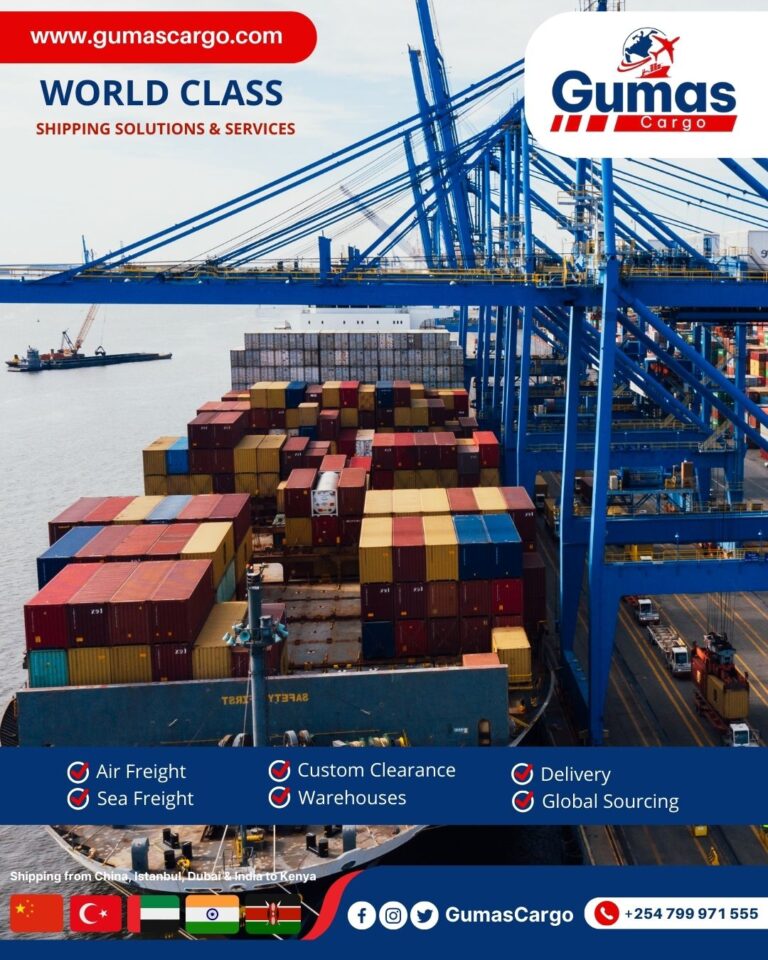

- Bill of Lading (sea cargo) / Airway Bill (air cargo): Essential for shipping logistics.

- Certificate of Origin: Proves where the goods originate.

- Freight Invoice (for sea cargo): Details shipping costs.

- Logbook and Translation (if not in English): Required for motor vehicles.

- Permit/License for restricted goods.

- Personal or Taxpayer Identification Number (PIN Certificate).

- Exemption Letter (if applicable).

- Purchase Orders/Contracts: Formalize agreements with suppliers.

- Certificate of Roadworthiness (for motor vehicles).

- Packing List: Itemizes contents of each shipment.

- Letter of Credit (if available).

4. Processing and Declaration

Your customs clearing agent will declare the goods on your behalf using the Integrated Customs Management System (ICMIS). Here’s how it works:

- Provide your clearing agent with original documents received from your supplier.

- The agent ensures all necessary documentation is attached and submits it to the Customs Services Department.

- Pay a processing fee based on either a minimum amount or a percentage of the CIF value.

5. Certificates of Compliance

These certificates are processed by relevant authorities in the supplier’s country:

- KEBS (Kenya Bureau of Standards)

- KEPHIS (Kenya Plant Health Inspectorate Service)

Certificates may include:

- Certificate of Analysis

- Phytosanitary Certificate

6. Release Order

Issued by the port authority, this document allows goods to be released after verification and payment of charges accrued during storage.

Conclusion

Navigating the import process requires attention to detail and adherence to regulations. By following these steps and working closely with your customs clearing agent, Kenyan entrepreneurs can successfully import goods from around the world. Remember that each country may have specific requirements, so stay informed and stay compliant! 🌍📦✨

At Gumas cargo, we offer air cargo, sea cargo, land cargo, door to door, online shopping, parcel delivery, warehouse storage, custom clearance and brokerage at competitive rates. We also offer tailor-made solutions for your cargo services. Gumas Cargo prides itself on offering the highest levels of service to its customers.